Gas stocks tumble in crude oil crash

March 24, 2020

Stocks of gas compressor and pipeline companies plunged today, dragged down by a 25% freefall in crude oil prices.

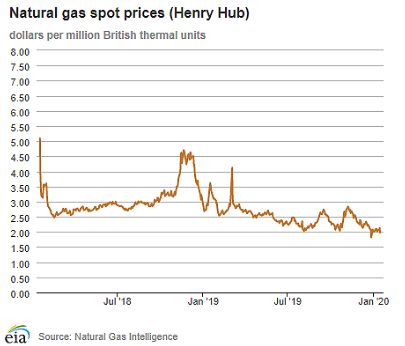

Benchmark Henry Hub gas futures closed 11 cents higher at US$1.82 per MMbtu. It had drifted down from US$2.33 per MMbtu early last December due to oversupply and warmer weather.

West Texas Intermediate crude fell US$10.26/bbl to US$31.02/bbl after the Organization of Petroleum Exporting Countries and Russia failed to agree on production cuts, prompting price discounting and higher output from Saudi Arabia.

Also, the International Energy Agency said that global oil demand oil will decline this year for the first time since 2009 because the coronavirus pandemic has caused a “deep contraction” in China’s oil demand along with major disruptions to global travel and trade.

The Dow Jones Industrial index fell 7.8% to 23,851, its worst day since 2008. Among compression sector stocks, Archrock fell 26% to US$4.44, USA Compression 22% to US$9.65 and Enerflex 21% to US$5.60.

Among pipeline stocks, Energy Transfer dropped 27% to US$7.38, Kinder Morgan 16% to US$16.09 and OneOk 37% to US$38.10. Smaller oil and gas produces were hard hit. Apache fell 54% to US$11.31, Marathon Oil 47% to US$3.59 and Diamondback 45% to US$26.88. ExxonMobil declined 12% to US$41.56 and Chevron 15% to US$80.67.